Born on this day!! Vocalist Yoko Ono is 88. Singer Herman Santiago of Frankie Lymon and the Teenagers is 80. Singer Irma Thomas is 80. Actor Jess Walton (“The Young and the Restless”) is 75. Singer Dennis DeYoung (Styx) is 74. Actor Cybill Shepherd is 71. Singer Randy Crawford is 69. Drummer Robbie Bachman of Bachman-Turner Overdrive is 68. Actor John Travolta is 67. Actor John Pankow (“Mad About You”) is 66. Game show hostess Vanna White (“Wheel of Fortune”) is 64. Actor Jayne Atkinson (“Criminal Minds”) is 62. Actor Greta Scacchi is 61. Actor Matt Dillon is 57. Rapper Dr. Dre is 56. Actor Molly Ringwald is 53. Guitarist-keyboardist Trevor Rosen of Old Dominion is 46. Actor Ike Barinholtz (“The Mindy Project”) is 44. Actor Kristoffer Polaha (“Ringer,” “Life Unexpected”) is 44. Guitarist Sean Watkins of Nickel Creek is 44. Actor Tyrone Burton (“The Parent ‘Hood”) is 42. Musician Regina Spektor is 41. Bassist Zac Cockrell of Alabama Shakes is 33. Actor Shane Lyons (“All That”) is 33. Actor Sarah Sutherland (“Veep”) is 33. Actor Maiara Walsh (“Desperate Housewives”) is 33.

THIS DAY IN GENIUS HISTORY

1546 – Martin Luther, German leader of the Protestant Reformation, died.

1564 – Michelangelo Buonarotti, Italian painter, sculptor, and architect, died.

1885 – The Adventures of Huckleberry Finn by Mark Twain was published.

1930 – Pluto, the ninth planet in the solar system, was discovered by American astronomer Clyde Tombaugh.

1953 – The first 3-D movie, Bwana Devil, opened in New York.

2001 – FBI agent Robert Philip Hanssen was arrested and charged with spying for Russia.

2001 – Dale Earnhardt, Sr., died from injuries sustained at the Daytona 500.

Today Is: Battery Day, Cow Milked While Flying In An Airplane Day, Discover Girl Day, International Eat Ice Cream for Breakfast Day, Introduce A Girl to Engineering Day, National Drink Wine Day, National Hate Florida Day, Pluto Day, The Great American Spit Out

TODAY ON TV!

Primetime TV (All Times Eastern)

CBS – 8:00 – Young Sheldon / 8:30 – B Positive / 9:00 – Mom / 9:30 – Unicorn / 10:00 – Clarice

NBC – 8:00 – Mr. Mayor / 8:30 – Young Rock / 9:00 – Law and Order: SVU / 10:00 – Dateline NBC

ABC – 8:00 – Celebrity Wheel Of Fortune / 9:00 – The Chase / 10:00 – The Hustler

FOX – 8:00 – Hell’s Kitchen / 9:00 – Call Me Kat / 9:30 – Last Man Standing

CW – 8:00 – Walker / 9:00 – Legacies

TV Talk Shows

Jimmy Fallon: Rami Malek, Bridget Everett, Jesus Trejo (R 1/27/21)

Stephen Colbert: George Clooney, Tom Hanks, Meryl Streep, the Mountain Goats (R 1/8/21)

Seth Meyers: Amy Schumer, Thomas Middleditch, Matt Cameron (R 2/3/21)

James Corden: Nicole Kidman, Kerry Washington, Phoebe Bridgers (R 12/16/20)

Lilly Singh: Lily Rabe

Conan: Jay Baruchel (R 2/1/21)

Watch What Happens Live: Kyle Cooke, Amanda Batula

The Talk: Eric Christian Olsen, Daniela Ruah

Live with Kelly and Ryan: Leslie Mann, Monica Mangin

Ellen DeGeneres: Neil Patrick Harris

The Real: Robin Thicke, Keri Hilson, Deborah Joy Winans

Kelly Clarkson: Kevin James, Alyson Hannigan, Valerie June

Drew Barrymore: Kat Dennings, Garcelle Beauvais

WHAT ARE YOU TALKIN’ ABOUT? Here are today’s PPM-Friendly Topics!

QUESTION: What turns you on about a guy and makes him GOOD IN BED?? A new survey shows that women like BEARDS, BROAD SHOULDERS AND TATTOOS!! Duh!!!

QUESTION: Don’t you hate it when divorces DON’T WORK OUT?? Kanye West is spotted WEARING HIS RING in Malibu!! Come on, guys, don’t back out now!!!!!!!!

QUESTION: How bad was DEMI LOVATO’S OVERDOSE?? She had three strokes and heart attack… and ALMOST DIED!! She comes clean in a new documentary!!!!!!!!

QUESTION: Is his good deed actually being REWARDED?? The doctor who removed the Gorilla Glue says his phones are being FLOODED with patient inquiries!!!!

QUESTION: Is there really such a thing as BEER GOGGLES??!! This doctor says “YES!!!” and it works a lot better on MEN than on WOMEN!!! And there’s more……

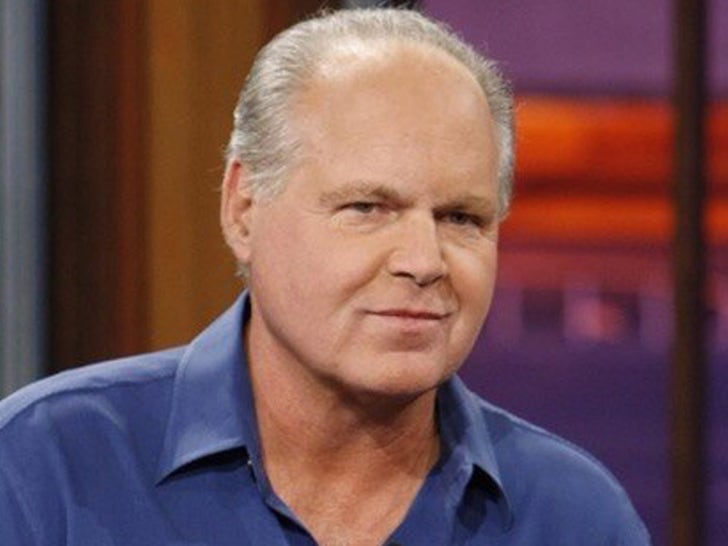

Rush Limbaugh Dies

Longtime radio show host Rush Limbaugh has died at the age of 70, his wife announced Wednesday on his program. Limbaugh, who has long been considered one of the country’s top conservative pundits and Republican supporters, has been receiving treatment for lung cancer. A statement posted to his website stated, “In loving memory of Rush Hudson Limbaugh III, the greatest of all time.” Several prominent Republican politicians praised Limbaugh upon news of his death Wednesday. “RIP to a legend and a patriot,” tweeted Kentucky Sen. Rand Paul. “Not many people can say they revolutionized and stayed at the top of an industry the way he did.” “Rush is the [greatest of all time] of radio, of conservative media and of inspiring a loyal army of American patriots,” added Florida Gov. Ron DeSantis. At the age of 20, Limbaugh began his radio career in 1971 as a disc jockey at Pennsylvania station WIXZ. He launched an afternoon radio show in Kansas City four years later, followed by stops in Sacramento and New York City before his program went into syndication.

OUR THANKS to Rush for making great radio look easy!!!

*******He’ll go down as the guy who saved AM radio!!!

TIP: Don’t say too many nice things about him, or you’ll be canceled!!!!

Prince Philip Hospitalized

Prince Philip has been hospitalized as a precaution after he began feeling ill, Buckingham Palace said Wednesday. He was admitted to London’s King Edward VII Hospital on Tuesday night, officials said. He was expected to remain there for several days of rest and observation. King Edward VII Hospital is a private facility that’s treated the British royal family for decades. The duke of Edinburgh, who will turn 100 years old in June, celebrated his 73rd anniversary with Queen Elizabeth II in November. Both received a COVID-19 vaccine in January. Philip, who retired from public duties in 2017, has lived with the queen at Windsor Castle since the pandemic started. He was last seen in public last summer while transferring the role as colonel-in-chief of The Rifles to his daughter-in-law, Camilla, duchess of Cornwall, who is married to Prince Charles.

********He must have gotten that second COVID shot!!!

******When they asked what was wrong with him, the palace spokesman said, “HE’S ALMOST 100!!! THAT’S WHAT’S WRONG!!!”

*******He’s requested a conjugal visit from the Queen!!! “And bring the blue pills!!”

*******Charles has already asked if he can inherit his shoes!!!!

Shawn King Says Larry King Kept A Secret Account

Larry King’s estranged widow Shawn King has filed a lawsuit over his recently-revealed secret will. Last week, King’s brief will was leaked and stated that he wanted his $2 million estate to be divided among his children. Notably, the document mentioned his two now-deceased children among the beneficiaries. The document, which was composed shortly after King filed for divorce from Shawn, made no mention of his estranged wife. In court documents filed by Shawn on Tuesday, she opposed the “purported holographic will” as well as “the Ex Parte Petition of Larry King, Jr. … for Letters of Special Administration.” Also mentioned in the suit was an alleged “secret account” owned by King, through which, he “would make gifts to various individuals from community property, without Shawn’s knowledge.” The docs allege that King had gifted King Jr. over $266,000 between Jan. 1, 2013 and July 31, 2018. Shawn claims to have the right to declare the “gifts void and recover” between 50-100% of the gifts’ value.

********It’s good to know that even a rich guy like Larry had to hide money from his wife!!

*******Nothing irritates a wife like children from a previous wife!!!

*******Let’s hope she doesn’t find a few children floating around by other women!!!

Meghan And Harry’s Pregnancy Photo Taken On iPad

Misan Harriman, the photographer who captured Prince Harry and Meghan Markle’s second pregnancy announcement, has opened up about his role in the unique photo shoot. Appearing virtually Tuesday on “Good Morning America,” the London-based Harriman shared how “technology came to the rescue,” when it came to photographing the Sussexes, who are currently living in California. “In the age of COVID, it’s impossible obviously for me to be there to shoot it, so technology came to rescue,” Harriman said. “I was able to remotely take over the iPad and they could hear my voice and it was conversational and the rest really is history,” he continued. Harriman, a close friend of the Sussexes and the first black photographer to shoot British Vogue’s September issue, added Tuesday, “You don’t even see the image, you feel it.” “They are lost in each other,” Harriman said of the photograph, in which Meghan is seen cradling her baby bump as she rests her head on Harry beside a massive tree. “And the tree in the background and just life growing around them is incredibly powerful and symbolic,” he continued.

**********Someone said she looks like the woman with an alien in her stomach in “Total Recall!!!”

********Her new baby will be born in America, which means she could be president!!

********Meghan’s dreams of world conquest are coming true!!!

******Did he just say he took over their iPad?? Can anyone do that?? Is someone watching us right now???

Silence Of The Lambs House To Be Bed and Breakfast

“Silence of the Lambs” fans will soon be able to stay at the dimly lit, wallpapered house where Buffalo Bill skinned his victims in the 1991 hit movie starring Jodie Foster, Anthony Hopkins and Ted Levine. New York theatrical art director Chris Rowan purchased the home for $290,000 on January 28 and plans to convert it into a quaint bed and breakfast, TMZ reported. The investment comes as the movie turns 30 and a “Silence” spinoff, CBS’s series “Clarice,” is embraced by some fans and chewed out by others. Rowan won’t have to do much to restore the four-bedroom, one-bathroom house to its horror glory — the home outside Pittsburgh, Pennsylvania, already has many of its original features, including its old-fashioned wallpaper, hardwood floors, pocket doors and dark wood trim. And the exterior of the three-story house is the same yellowish-red brick with a wraparound porch as seen in the movie.

*********Instead of a bed, you can also choose “Dungeon and Breakfast!!!”

*******The scariest thing?? It has four bedrooms and only one bathroom!!!

*******Dinner is the same every night: liver, with some fava beans and a nice Chianti!!!

The Rock Considers Presidential Run

Dwayne “The Rock” Johnson is not ruling out a potential presidential campaign in the future if the idea gains significant support. In an interview with Erin Jensen of USA Today, Johnson discussed what it would take to get him to run for President of the United States: “I would consider a presidential run in the future if that’s what the people wanted. Truly I mean that, and I’m not flippant in any way with my answer. That would be up to the people. … So I would wait, and I would listen. I would have my finger on the pulse, my ear to the ground.” Running for president is something The Rock has been asked about often in recent years. It dates back to an interview with British GQ in 2016 in which he said he hadn’t “ruled politics out.” Johnson said in the same interview that the idea of being a governor or president was “alluring.” In 2018, Johnson said he was seriously considering running for president someday, mentioning 2024 and 2028 as potential target elections.

*******Just when you thought it couldn’t get any better!!!!

********He’ll be running in the “Jumanji Party!!!”

*******If he picks Kevin Hart as VP, we’re in!!!!!

Paris Hilton Engaged

Paris Hilton is engaged to venture capitalist Carter Reum. He proposed to her on a private island on Feb. 13 after dating for a year, according to Vogue. He popped the question with an emerald-cut diamond ring designed by Jean Dousset. “I am excited about this next chapter and having such a supportive partner,” Hilton told Vogue. “Our relationship is one of equals. We make each other better people. He was absolutely worth the wait!” Her sister, Nicky Hilton, was present for the proposal. On Instagram on Wednesday, Hilton shared the good news alongside photos from her engagement, writing, “When you find your soulmate, you don’t just know it. You feel it.” This would be Hilton’s first marriage, although she has been in engaged in the past. She and ex-boyfriend Chris Zylka called off their engagement in November 2018.

********Now she’s looking forward to calling off her engagement to this one!!!!! That’s always fun!!!

********She actually wants to follow through and get married!!! That way she can schedule a divorce!! More drama!!

Ripping The Tabloids (Throughout the week, we’ll give you the stories from that weeks tabs!)

**Please Credit Publication!

Eva & Ryan Engaged-After 10 Years, 2 Kids-(National Enquirer)

Longtime lovers Eva Mendes, 46, and Ryan Gosling, 40, don’t rush things-which could explain why after being together since 2011, it seems they’re finally set to marry! The “Hitch” star sure looked like she’s getting hitched as she sported a giant ring during a recent hike. The intensely private couple share two daughters, Esmeralda, 6, and Amada, 4.

Nikki Waltzes “DWTS” Into Therapy-(Globe)

“Total Bellas” reality star Nikki Bella’s blabbing she’s totally waltzed her cranky fiancé, Russian-born “Dancing with the Stars” twinkletoes Artem Chigvintsev, into couples therapy. “When he gets really stressed, he doesn’t realize his tone,” complains the 37-year-old former wrestler. “We’re actually in therapy for this.” The pair, who share infant son Matteo, first met when they teamed up on the ABC dance competition show in 2017, while she was still with ex-fiance John Cena. “I am quitting, he is a d**k! she recalls grousing to John about her dance partner’s coaching style. “I remember during dress rehearsals sometimes I’d be like, ‘Is he mad at me?’ It would make me feel really off. It was hard, it was hard on me a lot.” Guess he’s still stepping on her toes!

Kourtney & Travis: Officially Accepted-(Us Weekly)

Travis Barker has already got the stamp of approval from one very important person in Kourtney Kardashian’s life: ex and father of her children Scott Disick. “He is OK with [their relationship],” a source says. “He isn’t jealous over it. They still have an incredibly special bond.” Kardashian, 41, for her part, is enjoying the moment with the drummer, 45. Adds the source, “He makes her laugh and she just adores that about him.”

More Bodyguard to Boyfriend: Heidi Klum & Martin Kirsten-(Star)

After her split from husband Seal, the model found solace in the arms of her paid protector. “He’s a great man and recently we just got to know each other from a completely different side,” the mom of four, now 47, gushed in 2012. (While the America’s Got Talent judge swore she’d been faithful during her marriage, Seal accused her of “fornicating with the help.”) In 2017, three years after his split from Heidi, Martin was the last person to see rocker Chris Cornell before he died in his Detroit hotel suite.

Say What?!-(Life & Style)

“When my eyes get puffy, I pull out my Foreo Iris massager-it mimics the tapping used in traditional Asian skin care. It looks like a vibrator, so I call it my eyebrator. I get funny looks when I use it in the back of a car or when I go through customs at the airport.”-Gemma Chan, on her “soothing” beauty secret.

“Sometimes being bigger, people didn’t necessarily look twice at you. And now that I’m in good shape, like, people offer to carry my groceries to the car and hold doors open.”-Rebel Wilson, who recently lost 60 pounds.

“I didn’t want, like, weird-ass names for our kids. They’ve already going to have enough trouble.”-George Clooney, on choosing the monikers Ella and Alexander for his 3-year-old twins with wife Amal.

One Last Thing: Allison Janney-(People)

The Oscar winner, 61, stars in the new film Breaking News In Yuba County.

Last guilty pleasure-

Last night I realized I didn’t have any food, so I made a big bowl of pasta with olive oil, butter, salt, pepper and Parmesan cheese. I go to it when I really want comfort food; it’s my heaven.

Last moment of pride-

My niece got her pilot’s license and flies around and rescues animals for Amelia Air. And my nephew works behind the scenes I’m just so proud of everything they’re accomplishing in their lives.

Last time I was late-

I’m never late; I plan ahead. Prior planning prevents poor performance. I think it’s from my years of training in the theater. If you’re late past a half hour, they replace you and the understudy goes on.

Loser of the Week-(In Touch)

Spike Lee-

The director’s acclaimed film Da 5 Bloods is snubbed by the Golden Globes-just two weeks after his daughter, Satchel, and son, Jackson, are named ambassadors for the awards show!

STUPID NEWS

Peacock On the Loose!

Officials in a New Zealand city are attempting to find the owner of an exotic bird after a peacock was found taking a stroll down a suburban road. The Wellington City Council said officials were alerted to a loose peacock in the Newlands area when onlookers snapped photos of the colorful wanderer and posted them to social media. The peacock, a species of bird native to India, Southeast Asia and Central Africa, was rounded up by authorities and taken to the Moa Point Animal Welfare Center. Officials said the peacock is friendly with humans and appears to be an escaped pet. They are now appealing for the animal’s owner to come forward. The peacock’s owner has seven days to come forward before the bird is rehomed at a shelter for rescued animals, officials said. See it HERE.

********Drug dealers use peacocks as lookouts!! (true) They scream when strangers show up!!

*******The other birds were so jealous, they kicked him right in the peanuts!!!

Expensive Dog

Guinness World Records announced a border collie named Kim sold for $38,893 at an auction, breaking the record for the world’s most expensive sheepdog. Guinness said Kim was auctioned online by Farmers Marts in Dolgellau, Wales, and fetched the steep price of $38,893, breaking the record previously set when a sheepdog named Henna sold for $26,088 at an October 2020 auction. The record-keeping organization said Kim’s high price is especially notable given that the auction occurred one day before the canine’s first birthday. Dewi Jenkins, the farmer and competitive sheepdog trainer who raised Kim, said she already has the intelligence of a 3-year-old sheepdog.

*********Get the flock out of here!!!

********Ewe have to be kidding!!!

*******It sounds like a lot of money, but the dog also cooks and cleans!!

Body Parts Turn Out To Be Mannequin

The California Highway Patrol said troopers responding to a report of body parts floating in the water next to a highway ramp were relieved to discover the limbs and torsos actually were mannequin parts. The CHP said a trucker who caught a glimpse of the seemingly grisly sight at the Arch Road on-ramp near Highway 99 in Stockton called 911 to report a suspected dismembered body floating in the water. Troopers arrived and discovered multiple mannequin torsos, arms and legs floating in the water, instead. The CHP joked in a Facebook post that the scene was the result of the lovelorn “Stockton Kraken” going on a Valentine’s Day killing spree. See the video HERE.

**********Parts is parts!!!

********First he saw the torso… then saw even more so!!!!

*******This is what happens when we ship arms to China!!!

Croc Goes Under The Knife

A crocodile from a Florida zoo underwent surgery to remove a shoe swallowed by the reptile when it fell from a zipliner’s foot. The University of Florida College of Veterinary Medicine said the 11-foot crocodile was brought to the facility Feb. 5, after ingesting a shoe that fell from a zipliner’s foot at the St. Augustine Alligator Farm Zoological Park. Veterinarians said the croc had originally thrown up the shoe, but ate it a second time. Vets attempted to get the crocodile to vomit again, but without success. The 341-pound crocodile ended up undergoing a gastrotomy surgical procedure to remove the footwear from its stomach. The crocodile, named Anuket, was kept overnight for supervision and is now recovering in its enclosure at the zoo. See the Pic HERE.

*********Uh… do we really NEED more alligators???

STUFF THAT’S COOL AND VIRAL

VIDEO: TRAIN VS. SEMI TRUCK!!!!

VIDEO: FROZEN PIPES BURST AT THE BUFFALO WILD WINGS!!

A LIST FOR THURSDAY

7 Important Tax Changes For 2020 You Should Know When You File

Huffington Post

The standard deduction increased.

Some people itemize their taxes, meaning they claim individual tax deductions that apply to their financial situation and write off the total amount from their taxable income. However, you only itemize if your individual tax deductions exceed the standard deduction.

About 90% of taxpayers qualify to take the standard deduction. This deduction reduces your taxable income by a fixed amount, depending on your tax filing status. It’s set each year and adjusted for inflation. And for tax year 2020, the standard deduction was increased, allowing you to reduce your taxable income by a bit more than you did in 2019.

This year, the standard deduction for single taxpayers and those married filing separately is $12,400, up from $12,200 the previous year, according to Arnold van Dyk, an attorney and director of tax services at TaxAudit. For married taxpayers filing jointly, it has been raised from $24,400 to $24,800, and for heads of households, it was increased from $18,350 to $18,650.

Contribution limits for health savings accounts went up.

Certain tax-advantaged savings accounts have caps on how much you can contribute each year. Those maximums increase over time, and last year, that was the case for health savings accounts.

So why does that matter now? If you didn’t max out your contributions in 2020, you have until April 15 of this year to do so.

HSA contribution limits were raised modestly. You can contribute up to $3,550 for yourself, or $7,100 for families for tax year 2020 (those limits were previously $3,500 and $7,000, respectively). The annual “catch-up” contribution amount for individuals age 55 or older will remain at $1,000, van Dyk noted.

There’s a new “lookback rule” for certain tax credits.

Many people had changes to their employment and income in 2020 due to the pandemic, which means they may qualify for lower amounts of certain credits. However, a new “lookback rule” established last December may allow taxpayers who qualify for the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) to get more money back during a particularly tough year.

This new rule allows certain taxpayers to “look back” at their 2019 income and claim these credits based on that year’s earned income if it was higher than their 2020 earned income.

This doesn’t happen automatically, though. You or your tax preparer will have to compare the two years and choose the option that allows you to claim the largest credits.

A new tax credit for stimulus payments was created.

Millions of Americans received a stimulus check in 2020 as part of a greater coronavirus relief package. That money was actually a tax credit for 2020, paid out in advance.

That’s why stimulus payments are not taxable ― they’re credits that reduce your taxable income for the year. However, since the IRS didn’t have everyone’s 2020 tax returns, they based the stimulus check amounts off of information from 2018 or 2019 tax returns, whichever they had on file that was most recent.

Fortunately, if your financial situation changed since 2019 and you received too much stimulus money based on your 2020 income, you do not have to pay it back, says Lisa Greene-Lewis, a certified public accountant and tax expert for TurboTax.

Similarly, if you received too little or a partial payment, you can claim more in the form of a recovery rebate credit when you file your 2020 taxes, she added. “That goes for qualified dependents you didn’t receive stimulus payments for as well.”

For example, if you had a baby in 2020 and the IRS didn’t know that when they issued your stimulus payment, you can claim the stimulus for your new dependent when you file.

An above-the-line charitable contribution deduction was added.

Usually, you can only write-off donations to charity on your taxes if you itemize. However, in order to encourage charitable giving during the pandemic, a new provision under the CARES Act allows taxpayers who take the standard deduction to deduct up to $300 in donations.

This deduction is available for 2020 only and only applies to cash donations, including checks and online payments. Donations in the form of clothes, furniture, supplies and other items don’t count.

Greene-Lewis added that the CARES Act also temporarily eliminated the limit on the number of cash contributions you can deduct if you itemize your deductions. “Usually, cash donations that you can deduct are limited to 60% of your adjusted gross income, but the CARES Act eliminates the limit for tax year 2020 returns,” she said.

Penalties for retirement early withdrawals were suspended.

Usually, you aren’t allowed to take money out of your 401(k) or other retirement account before you reach age 59 1/2, otherwise you’re subject to taxes and other penalties. However, another change that resulted from the CARES Act was the elimination of the 10% early withdrawal penalty on up to $100,000 in retirement funds withdrawn if you are a qualified individual impacted by coronavirus.

Additionally, instead of having to pay taxes on those withdrawals in 2021, you are allowed to spread the tax payments out over three years. “For example, if you took a distribution of $30,000, you would be able to include $10,000 in income each year over three years as opposed to including the entire $30,000 in income for tax year 2020,” Greene-Lewis explained. You also have the option of paying that money back to your account, lowering your tax liability.

Several important tax provisions were extended.

In addition to the new tax changes outlined above, the CARES Act also extended some tax provisions that were set to expire in 2020. These are known as “tax extenders,” and the following are a few important examples, according to Lewis:

- Taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2020 adjusted gross income. That threshold was set to increase from 7.5% to 10% in 2020, but the reduction was permanently passed.

- For tax years beginning in 2020, volunteer firefighters and volunteer medical responders will be able to exclude payments provided by state and local governments for performing emergency response from their income. That exclusion is permanent.

- If you experienced a foreclosure, short sale or loan modification, you may still be able to exclude the amount of debt forgiven on your principal residence on your taxes.

- The ability to write off any mortgage insurance premiums paid, which are included in the mortgage interest deduction, was extended through 2021.

- Credits for nonbusiness energy property improvements made to your home (such as installing energy-saving roofs, windows, skylights, doors, etc.) were extended through 2021. “The provision still allows you to claim the nonbusiness energy property credit for 10% of amounts paid for qualified energy efficiency improvements, up to a lifetime cap of $500,” Greene-Lewis said.

The preceding material was compiled and edited by Brandon Castillo. The Editor-In-Chief is Gary Bryan. The Radio Genius Show Prep Service is licensed for use on-air only by subscribing radio stations. Other means of redistribution is forbidden.

© 2020 – Radio Genius Show Prep